While strong growth has returned to the payments industry, disruptive forces will continue to reshape the competitive landscape. A McKinsey & Company article.

Research and publish the best content.

Get Started for FREE

Sign up with Facebook Sign up with X

I don't have a Facebook or a X account

Already have an account: Login

Get weekly or monthly digest of all posts in your inbox: https://fmcs.digital/wim-subscribe

Curated by

Farid Mheir

Your new post is loading... Your new post is loading...

Jean-Marie Grange's curator insight,

September 17, 2013 10:16 AM

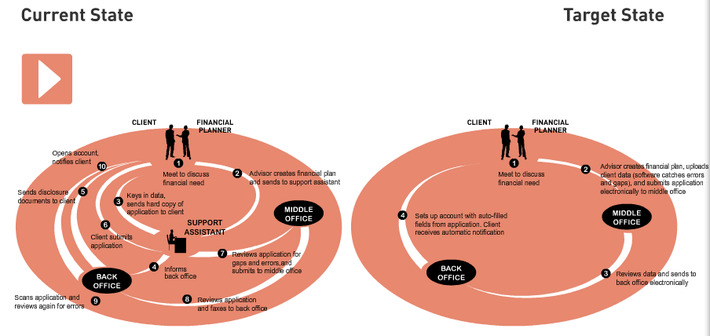

Short but very interesting interactive presentation of the advantages of process automation in the banking industry. This optimization of the client on boarding process can bring 15% to 30% savings to the bank costs.

DEMARLE chris's curator insight,

February 8, 2013 6:21 AM

Avec trois à sept contacts par an, dont un seul via Internet, les relations entre assurés et assureurs sont loin d'être aussi « digitales » qu'elles peuvent l'être avec les banquiers ou les acteurs de la téléphonie mobile et du Web. |

Curated by Farid Mheir

Get every post weekly in your inbox by registering here: http://fmcs.digital/newsletter-signup/

|

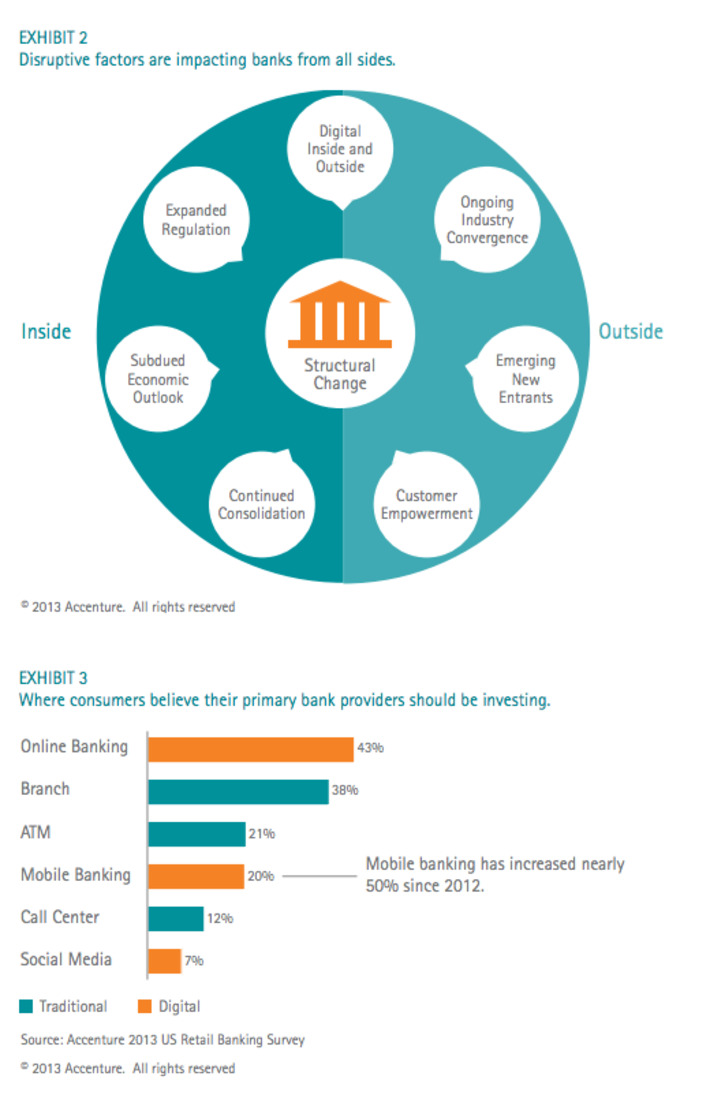

Opportunities and challenges for financial institutions and retailers alike.