Intel Capital has announced investments in 16 companies, totaling $65 million. The investments spanned cloud services, datacenter technologies, mobile and..

Intel Capital has announced investments in 16 companies, totaling $65 million. The investments spanned cloud services, data-center technologies, mobile and consumer-related services.

The investments are as follows:

CloudFX of Singapore is a cloud strategy consulting company that helps companies re-architect IT infrastructures, operations and helps institute DevOps style practices.Cloudian of Japan and the United States, is an object storage platform that is compatible with Amazon Web Services, Citrix Cloud Platform, Apache CloudStack, OpenStack and other cloud services.CSDN is a Chinese company that provides a community website and services platform for IT professionals in China. According to Intel Capital, it has 27 million registered users and 500,000 enterprise partner members. The company owns several Chinese IT communities such as CMDN, a mobile developer community and IT recruiting website Pongo.DotProduct provides software for real-time capturing and processing of 3-D data on Android tablets. Use cases include documenting crime scenes to imaging movies sets for gaming and entertainment applications.Wayz Japan is a service to store, manage, access, share and organize files anywhere on any device.Interlude is an Israeli platform provider to create interactive videos that allows viewers to determine what happens next in the viewing experience. Its authoring platform.-Treehouse, allows video creators to map, build and publish Interlude videos on Web, mobile and social platforms. Pretty cool.Lintes Technologies, is a Taiwan-based company that makes the Thunderbolt peripherals that provide high-speed data transfer. According to the company website, Thunderbolt was developed by Intel, and brought to market with technical collaboration from Apple.Perpetuuiti TechnoSoft Services of Singapore and India, offers advanced data recovery technologies that help businesses in complex IT environments, orchestrated across virtual and physical computing resources in different data centers.Prism Skylabs, which today received $15 million in funding, helps companies use footage from existing security cameras to provide retailers and other businesses with “web-style analytics.”Reduxio Systems, of Israel, boasts it offers infinite data recoverability through real-time primary storage deduplication and protection technologies.Rocketick, also of Israel provides software simulation acceleration for chip verification, helping reduce time-to-market of new designs.Savaari Car Rentals is an online car rental company that offers car rentals across 60 cities in India to both retail and corporate customers.SBA Materials develops “nano-porous dielectrics” that for example, can help improve the performance of advanced chips used in mobile devices while reducing their power consumption.SkySQL, of Finland, announced it has raised $20 million to deepen its support for MariaDB, the fast growing open-source relational database and the emerging database of choice for Wikipedia.WiTricity specializes in wireless electricity. The company was founded in 2007 with clients in consumer electronics, automotive, medical devices and defense.

Intel Capital is an active venture group. According to CB Insights, it is the third most active investor in security technology companies. The analyst group reports that it has recorded the highest number of security exits among investors since the start of 2012. Among Intel Capital’s recent security exits include FireEye and Palo Alto Networks.

For links to each of those companies, click on the title to see the original article on TechCrunch.

Via

Marc Kneepkens

Your new post is loading...

Your new post is loading...

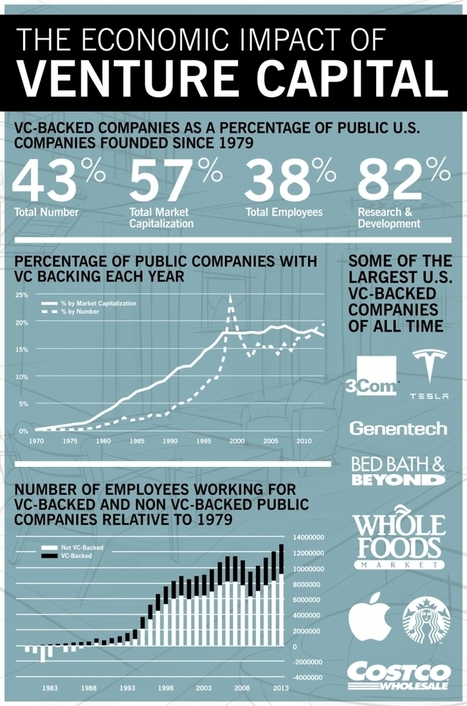

Interesting statistics! Definitely part of the overall mystic and fabric of Silicon Valley and high tech in general. Very creative and exciting soup of entrepreneurship, investment and high risk/rewards.

VC investment employ 38% of working force