Were you one of the first to identify Uber as a game changer? What about being one of the first to use Amazon or Google in the early days? If you had..

Were you one of the first to identify Uber as a game changer? What about being one of the first to use Amazon or Google in the early days?

If you had invested in Uber (now valued at $40B) in 2011, you would currently be sitting on a 600x return. Unfortunately, unless you were already very wealthy, securities laws would have prevented you from being able to invest in the these companies.

Early adopters have historically been prevented from crossing the threshold from customer to investor. However, a fundamental shift in the relationship between consumers and companies has been set in motion by new SEC regulations set to go into effect on June 19th.

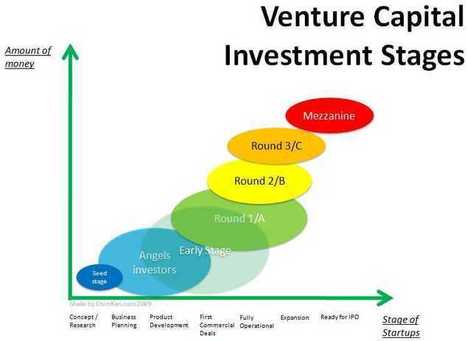

Most early adopters interested in supporting private companies have been limited to rewards-based crowdfunding. This type of crowdfunding has proven to be a poor substitute for true early stage investing. Rewards-based crowdfunding websites such as Kickstarter allow individuals to pre-order products or donate towards something that they want to exist in the world. These “backers” do not get shares or equity in the company. Although these backers take on significant risk, they do not get any significant upside.

The story of Oculus VR is apt. Nearly two years after its celebrated rewards-based crowdfunding raise, Oculus was acquired by Facebook for $2B. Oculus’ early Kickstarter backers felt angered and betrayed. Though they had a sense of ownership in the company, they reaped no benefits from the transaction. Meanwhile, the institutional and accredited investors who invested in Oculus after the Kickstarter campaign (and in large part because of the Kickstarter campaign) made a large amount of money in a short period of time. $300 in equity in Oculus at the time of the Kickstarter campaign would have been worth approximately $45,000, a 145x return.

Successful technology startups owe it to their early adopters to let them participate in the company’s financial success. These are the people who realized the company’s potential before the public and provided the momentum to turn that potential into a reality. Read more: click on image or title.

Via

Marc Kneepkens

Your new post is loading...

Your new post is loading...

Read and Heed