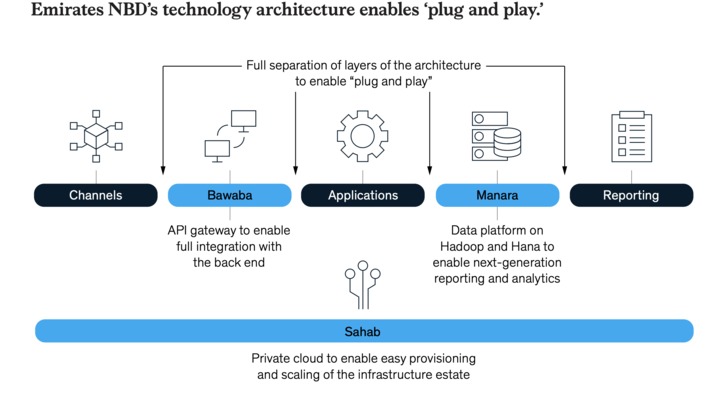

Emirates NBD’s Neeraj Makin and Saud Al Dhawyani discuss how APIs became central to their organization’s IT transformation.

Get Started for FREE

Sign up with Facebook Sign up with X

I don't have a Facebook or a X account

Your new post is loading... Your new post is loading...

Jules Johnson's curator insight,

September 7, 2021 2:22 AM

https://legitgunonline.com/

Brett Fribush's curator insight,

March 22, 2021 8:52 PM

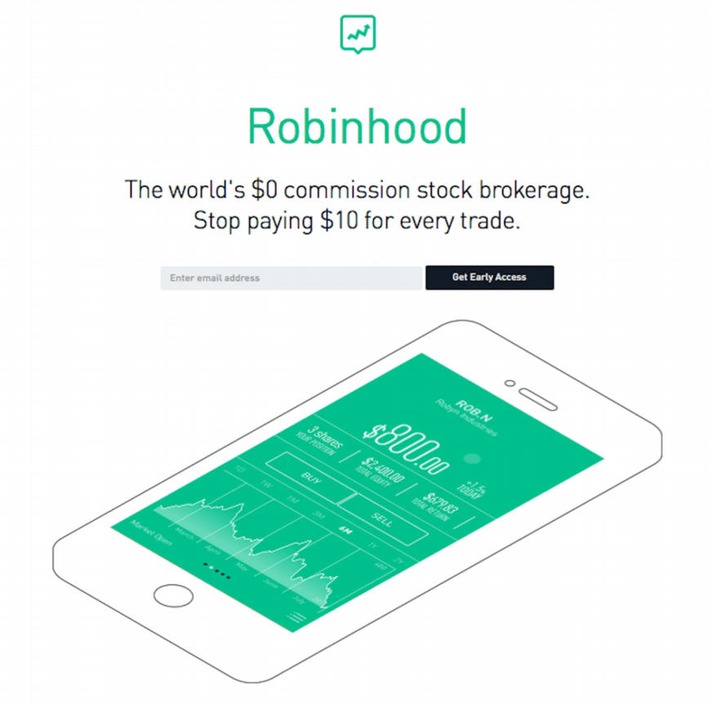

Robinhood went through a lot of trouble recently when the subreddit group Wallstreetbets decided they wanted to go against the hedge funds that were shorting stocks such as GameStop and AMC. It is interesting to see how they handled this situation and how they operate.

gregordragic's curator insight,

March 5, 2020 8:01 AM

a href=https://globalcannabisbay.com/product/smartbud/">; Buy Smartbud Online Smartbud. Buy Smartbud Online. Inside the smart bud cans, we seal the open pop-top lid to create an air-tight and completely odorless package. That is, until you pop the lid and inhale the ripe, harvest-fresh aroma. Smartbud Re-Usable & 100% Recyclable Smartbud cans includes a plastic lid to provide the ultimate scentless package, and makes it easy to store your weed even after opening your can. Discreet and easy to store, our canned weed keeps your cannabis safe as you travel. Buy Smart buds Online Inhibits Mold, Bacteria & Microorganisms Canned weed is the best way to prevent oxidation and molding. We use a professional grade canning machine to can our cannabis, and remove any oxygen to contain freshness. 100% Food Grade & Safe Once you’ve tried our canned cannabis, you won’t be able to go back to stuffing your weed in a plastic bag, jar. buy smart buds online. The only thing growing, distributing, Organic Smart Bud Cans (Min Order 10 Cans), and selling cannabis used to lead to was prison time. Now it’s becoming just as legitimate an industry as it was when our first president George Washington cultivated it on his Mount Vernon homestead. Of course, he grew hemp for mooring ropes, clothing, and such, while today’s growers harvest it reduce cancer patients‘ nausea and your brother’s boredom, but nonetheless, it is a legitimate way to earn a living. Mostly Here are some Flavors; Crazy Glue Punch Cake Gushers Skywalker OG Sex Fruit Purple Punchsicle Grape Ape Do-si-dos Amnesia Haze Blueberry Muffin Nubie OG Jack Fruit Reckless Rainbow Punch Breath Paris OG Glookies Lambs Breath Gushers Orange Cookies Double Dream Super Sour Diesel Lemon Slushie Strawberry Shortcake Grape Cola King Louis XIII XXX OG Cookies N’ Cream Purple Punch Durban Poison Uncle Gary’s BLKWTR Chocolope Gorilla Cookies Gelato Purple Rain Jack Herer SFV OG Gorilla Glue #4 Animal Cookies Girls Scout Cookies Banana OG Mimosa Buy Smartbud Online Web Link: https://globalcannabisbay.com/product/smartbud/

ZORINS TECHNOLOGIES's curator insight,

July 16, 2019 5:02 AM

ZORINS TECHNOLOGIES NETWORKING LEADER IN GLOBAL MARKET & CISCO PARTNER. PLEASE CONTACT US FOR CISCO PRODUCTS & MORE PRODUCTS LIKE NETWORKING, SERVERS, SMART BUILDINGS, DATA, VOICE COMMUNICATIONS, https://zorinstechnologies.com/index.php?route=information/contact #Zorinstechnologies #Globalleader #CiscoPartner #Networking #ITProducts #CCTV #Cisco #Dlink #HPE #UPS #Switches #Routers

More Updates Like: Zorins Technologies #Globalleader #Zorinstechnologies #CiscoPartner #Networking #ITProducts #CCTV #Cisco #Dlink #HPE #UPS #Switches #Routers

Vezta & Co.'s curator insight,

August 31, 2018 1:36 PM

WHY IT MATTERS: finance and accounting remain manual and paper-driven. However, there are advances with robotic process automation and solutions that aim to make accounting a continuous process, not a once a month struggle. Sure looks to me like something we have done in software engineering years ago with continuous integration and deployment.

Marie Torossian, CPA, CGMA's curator insight,

September 1, 2018 10:52 AM

How automated is your accounting process? I'm always looking for better integration of software to free up time for my staff to perform more analytics. Here's a nice read on Digital transformation in Finance and Accounting

Fabienne Fayad's curator insight,

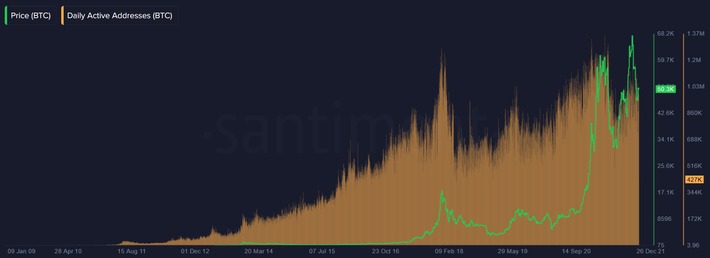

November 19, 2017 9:07 AM

What do you think of Bitcoins and Blockchain? This article is very interesting to read.

Waqas ALi's curator insight,

November 20, 2017 6:31 AM

Custom Logo design services are playing important role in the field of business and marketing most of the companies recognized by their logo. |

Curated by Farid Mheir

Get every post weekly in your inbox by registering here: http://fmcs.digital/newsletter-signup/

|

WHY IT MATTERS: executives must be technology literate in order for their business to be profitable. This article from McKinsey describes a bank digital transformation towards and API-driven architecture with modern cloud services.