Since 2009, Bank of America (BofA) has closed 1,597 branches in 253 counties across the US, selling the spaces to local banks in some areas and directing customers to further branches in others, according to The Wall Street Journal. For context, that's equivalent to 26% of the branches that the bank currently operates, and represents a big cut that's reflective of a rising industry trend.

Research and publish the best content.

Get Started for FREE

Sign up with Facebook Sign up with X

I don't have a Facebook or a X account

Already have an account: Login

Get weekly or monthly digest of all posts in your inbox: https://fmcs.digital/wim-subscribe

Curated by

Farid Mheir

Your new post is loading... Your new post is loading...

Emma Gongon's curator insight,

December 7, 2020 4:05 PM

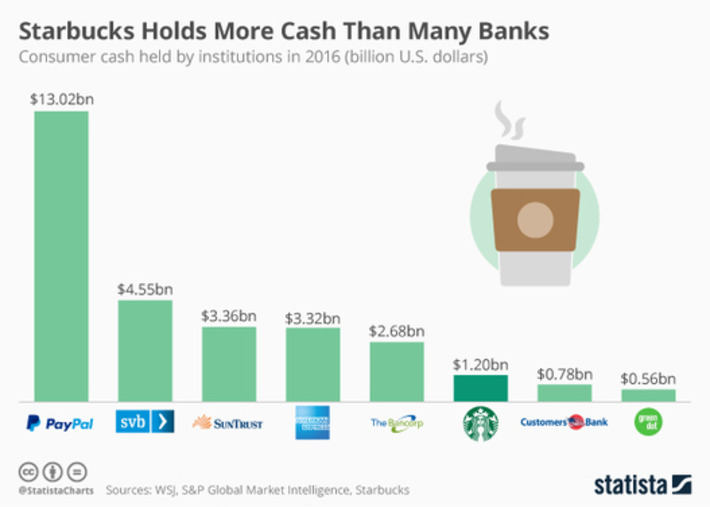

This was really interesting to see how much money people invest in their Starbucks. As a die hard Starbucks fan I spend so much money on my Starbucks but justify it by the rewards, so to me it was interesting to see that I am not alone.

|

Curated by Farid Mheir

Get every post weekly in your inbox by registering here: http://fmcs.digital/newsletter-signup/

|

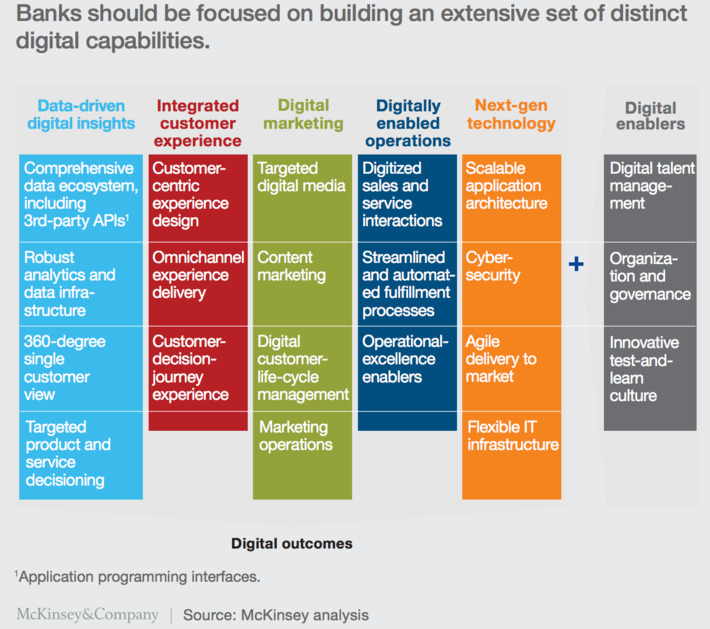

WHY THIS IS IMPORTANT

I remember a time in the late 90s early 2000s when cutting cost meant outsourcing to India. Today, it seems the trend is moving to digital. This stat from BofA is quite clear: digital saves costs.