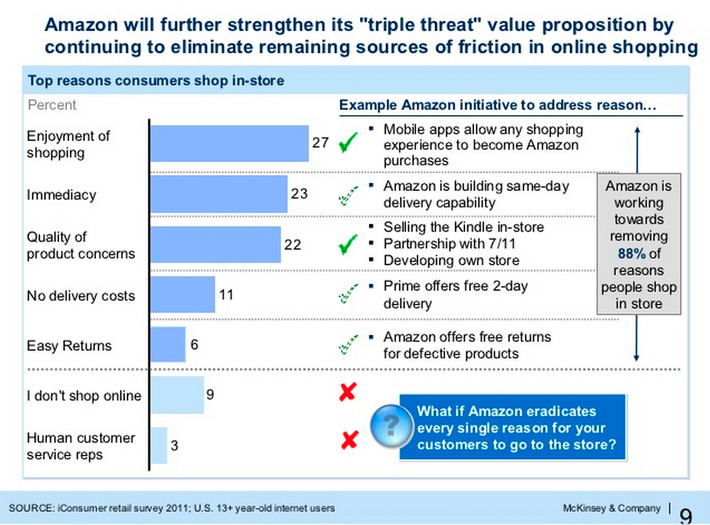

NEW YORK – A Forrester Research analyst at the Mcommerce Summit: State of Mobile Commerce 2013 conference said that three-quarters of consumers surveyed use their smartphones while in-store.

Research and publish the best content.

Get Started for FREE

Sign up with Facebook Sign up with X

I don't have a Facebook or a X account

Already have an account: Login

Get weekly or monthly digest of all posts in your inbox: https://fmcs.digital/wim-subscribe

Curated by

Farid Mheir

Your new post is loading... Your new post is loading...

|

Curated by Farid Mheir

Get every post weekly in your inbox by registering here: http://fmcs.digital/newsletter-signup/

|

Mobile in stores has enabled showrooming which in turn is flipping the shopping retail model. Before it was: go online to research (tv, cars, etc.) then go in store to buy. Now it is: go in store to browse and try then go online to buy (for less usually). Complete flip of the shopping world, brick and mortar retailers are bracing for online pure plays to steal their lunch.