Your new post is loading...

|

Scooped by

Farid Mheir

|

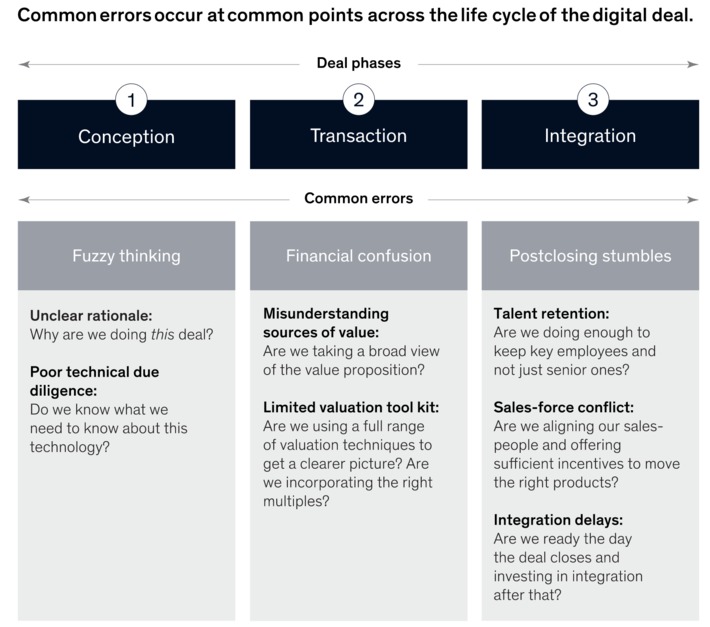

In our experience, technical due diligence is the single biggest differentiator of deals done well—or poorly. What’s more, technical due-diligence failures can usually be avoided. Almost always, the disappointed acquirer insufficiently vets the technology and discovers too late that it fails to work as advertised. Or the technology does work, but only in constrained environments, and won’t scale. In other cases, crucial parts of the IP turn out not to be owned by the seller.

|

Scooped by

Farid Mheir

|

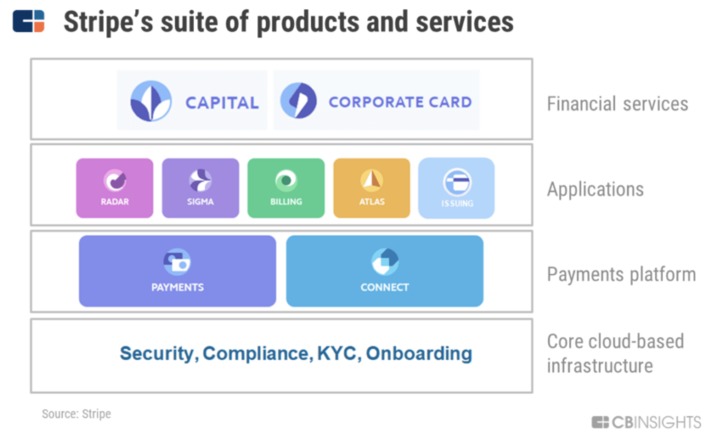

In this report, we dive into Stripe’s unique strategy, growth trajectory, product set, and where the $35B payments giant sees the global online commerce market heading next.

|

Scooped by

Farid Mheir

|

Is this 1999? It sure feels like it... It seems to us that profitless companies seem to be back in vogue. Recently, companies like Uber and Lyft have gone public with very disruptive business models but no profit in sight. At best, profit might come a long way down the road. Yet they are given market valuations at levels that suggest a wildly profitable business model.

|

Scooped by

Farid Mheir

|

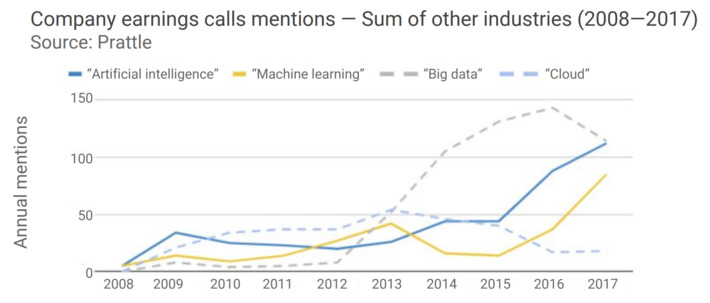

The graphs below show Artificial intelligence (AI) and Machine learning (ML) mentions in company earnings calls, by industry. The graph shows Artificial intelligence mentions by industries other than IT. Big data and Cloud mentions are added to put AI / ML mentions in perspective. This analysis uses only companies publicly traded on the New York Stock Exchange.

|

Scooped by

Farid Mheir

|

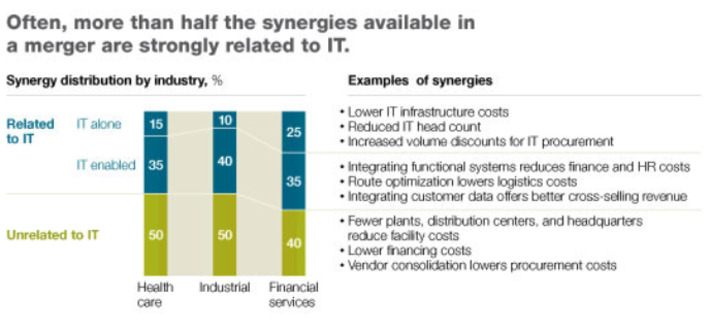

Many mergers don’t live up to expectations, because they stumble on the integration of technology and operations. But a well-planned strategy for IT integration can help mergers succeed.

|

Scooped by

Farid Mheir

|

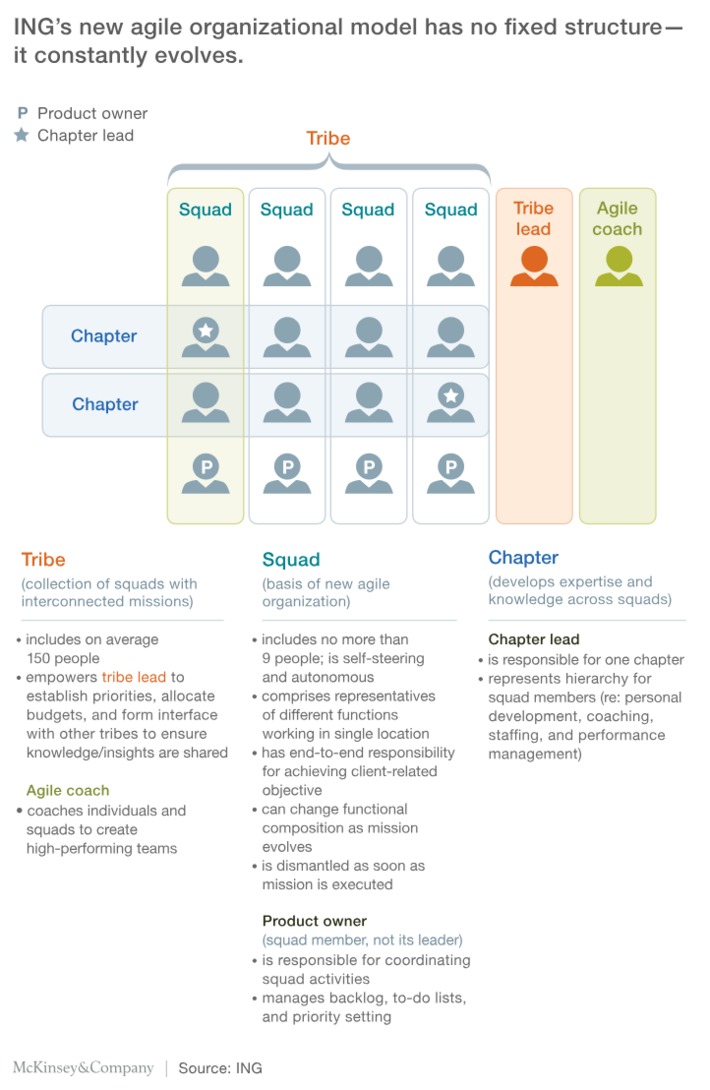

Established businesses around the world and across a range of sectors are striving to emulate the speed, dynamism, and customer centricity of digital players. In the summer of 2015, the Dutch banking group ING embarked on such a journey, shifting its traditional organization to an “agile” model inspired by companies such as Google, Netflix, and Spotify. Comprising about 350 nine-person “squads” in 13 so-called tribes, the new approach at ING has already improved time to market, boosted employee engagement, and increased productivity.

|

Scooped by

Farid Mheir

|

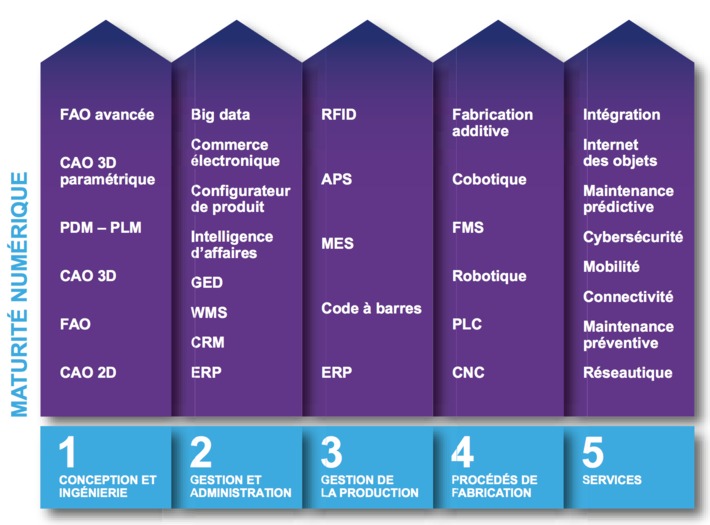

L’avènement de l’industrie 4.0 modifie les façons de faire des entreprises. Le numérique vient non seulement transformer les systèmes et les processus, mais apporte aussi des changements au sein des différentes fonctions de gestion d’entreprise. Afin de rester concurrentielles, tant les PME que les grandes organisations doivent se tourner vers les nouvelles technologies.

|

Scooped by

Farid Mheir

|

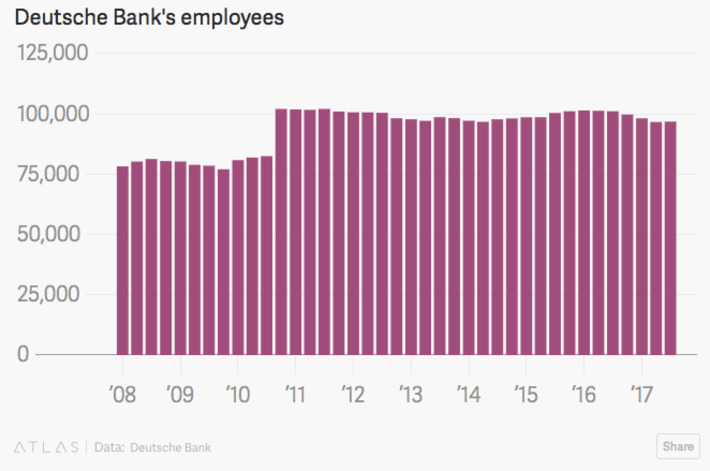

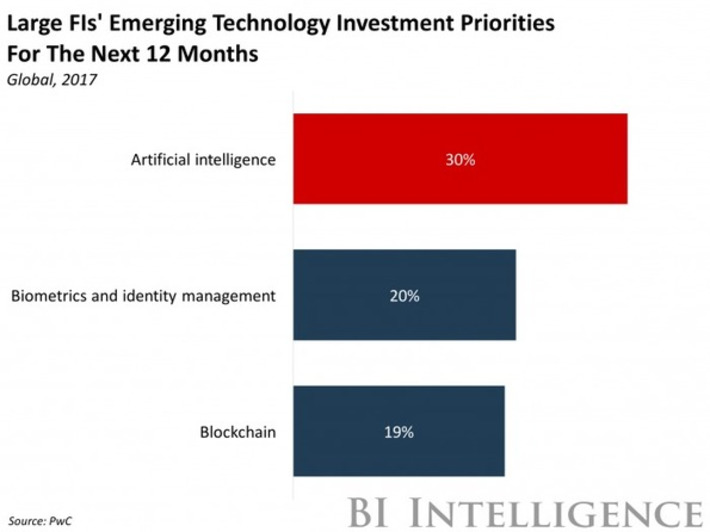

By next year, around 75% of financial firms will either explore or implement artificial intelligence technologies, according to a survey by Greenwich Associates. The research and consulting firm thinks some 15% of the industry’s jobs are at risk.

|

Scooped by

Farid Mheir

|

CRYPTO20 is an autonomous token-as-a-fund allowing you to invest in cryptocurrencies like bitcoin and ethereum in a diversified index fund.

|

Scooped by

Farid Mheir

|

In a remarkably frank talk at a Bank of England conference, the Managing Director of the International Monetary Fund has speculated that Bitcoin and cryptocurrency have as much of a future as the Internet itself. It could displace central banks, conventional banking, and challenge the monopoly of national monies.

|

Scooped by

Farid Mheir

|

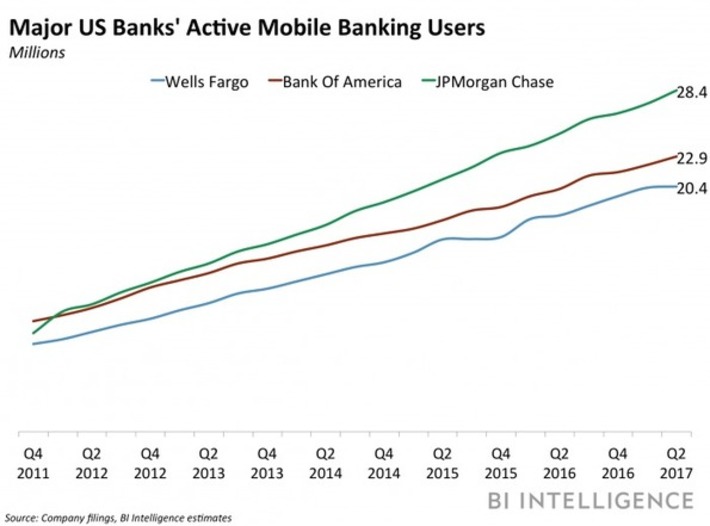

Since 2009, Bank of America (BofA) has closed 1,597 branches in 253 counties across the US, selling the spaces to local banks in some areas and directing customers to further branches in others, according to The Wall Street Journal. For context, that's equivalent to 26% of the branches that the bank currently operates, and represents a big cut that's reflective of a rising industry trend.

|

Scooped by

Farid Mheir

|

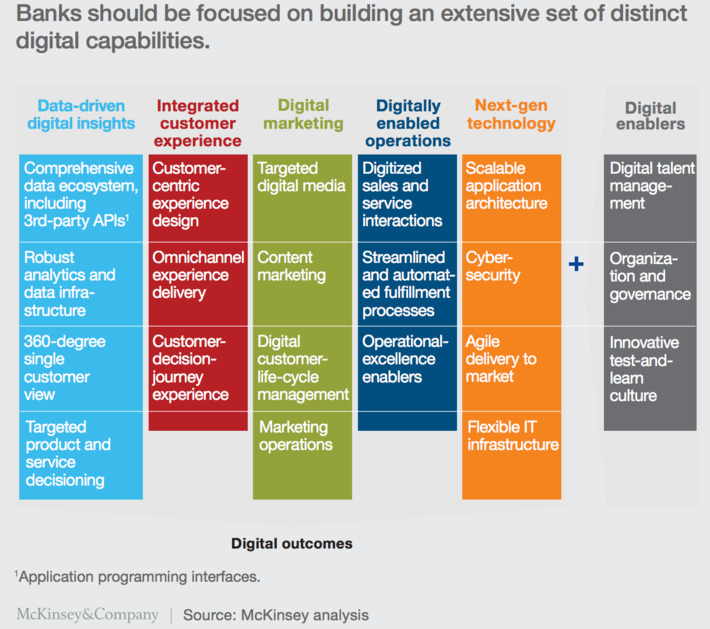

McKinsey’s summary of leading FinTech articles is a fantastic summary of the issues facing global financial services players. There are several sections in this 80-pager that we believe our clients will find the most value…. - Cutting through the noise (page 6) – this is a noisy space with many old and new entrants laying claim to a place in FinTech land. This section of the report truly cuts through the noise and presents a very clear view of the primary value drivers for F/S players and love the “6 Digital Imperatives” chart on page 12.

- Helping Incumbents not Disrupting (page 24) – the notion of cooperation vs. competition between FinTechs and Incumbents has emerged as a more realistic future for the industry. Canada has a unique F/S model with large, dominant and highly successful incumbents controlling the vast majority of clients and assets. We see cooperation as being the only role that we will play as a FinTech provider and this seems to be an increasingly popular position in our industry.

- Banking on the Cloud (page 49) – the movement from resistance to acceptance and now to adoption of cloud apps is accelerating. In our business, revenues generated from Cloud services have increased from 10% to 50% in just 3 years and the discussions that we have had with clients around “resistance” to the Cloud have virtually disappeared. Innovation at a higher pace and lower cost is becoming table stakes and embracing this technology is now an afterthought.

|

Scooped by

Farid Mheir

|

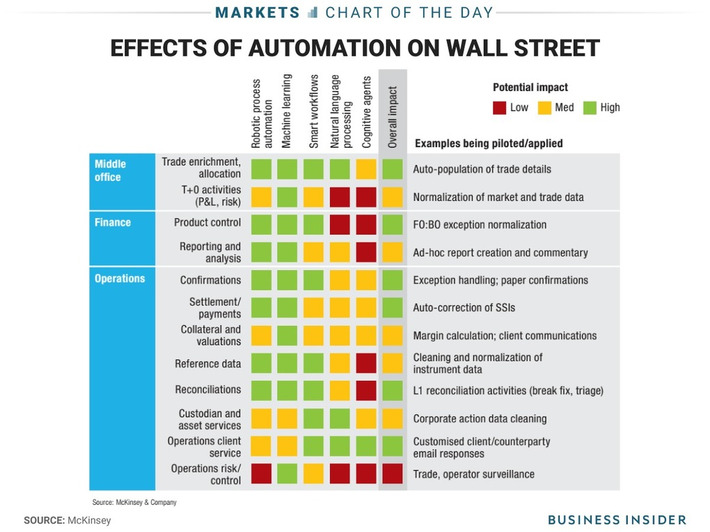

The robots are coming for Wall Street's jobs, and McKinsey & Co has an idea of exactly what jobs they are coming for. - Automated technologies could have a big impact on 60% of Wall Street jobs, according to a new report by McKinsey, the consulting firm.

- Integration of new technology doesn't guarantee big revenue spikes, but it is necessary to keep firms afloat in the digital age. Some big firms are already taking action.

|

Scooped by

Farid Mheir

|

HighRadius' solution uses AI, machine learning, and optical character recognition to identify a payer, match them to an uncontextualized payment, and match that to an open receivable. Moreover, it gives companies the option of sending an automatic prompt to customers whose debts are outstanding. By leveraging this solution, BAML aims to reduce costs for its large business clients.

|

Scooped by

Farid Mheir

|

Fintechs have matured rapidly in recent years, and the industry is entering a new phase of development. With no signs of the industry’s growth abating, its reach is likely to broaden quickly to embrace even newer technologies and offerings, blurring the boundaries now delineating financial services. As the momentum continues, some aspects of fintech are likely to reach into a broad swath of the global economy, much like how digital technologies have become a necessity, rather than an option, for every industry. Understanding the seven features that characterize this new era will allow companies to stake out the most valuable plots in the new landscape.

|

Scooped by

Farid Mheir

|

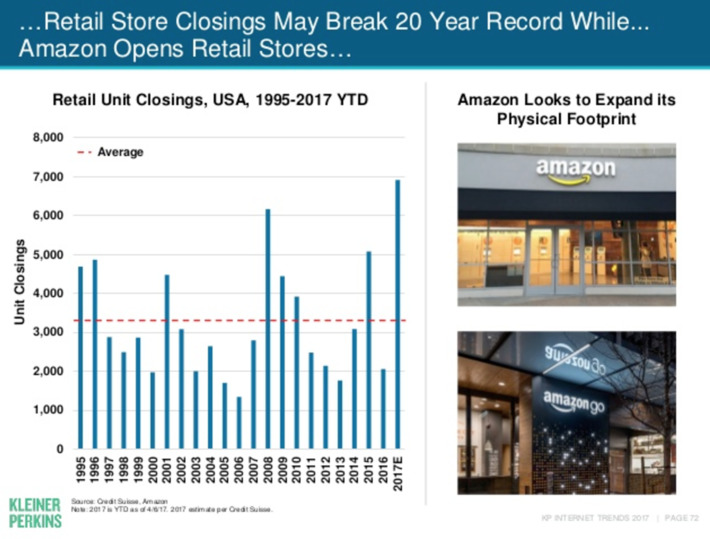

The most anticipated slide deck of the year is here. Key takeaways: - Global smartphone growth is slowing: Smartphone shipments grew 3 percent year over year last year, versus 10 percent the year before. This is in addition to continued slowing internet growth, which Meeker discussed last year.

- Voice is beginning to replace typing in online queries. Twenty percent of mobile queries were made via voice in 2016, while accuracy is now about 95 percent.

- In 10 years, Netflix went from 0 to more than 30 percent of home entertainment revenue in the U.S. This is happening while TV viewership continues to decline.

- Entrepreneurs are often fans of gaming, Meeker said, quoting Elon Musk, Reid Hoffman and Mark Zuckerberg. Global interactive gaming is becoming mainstream, with 2.6 billion gamers in 2017 versus 100 million in 1995. Global gaming revenue is estimated to be around $100 billion in 2016, and China is now the top market for interactive gaming.

- China remains a fascinating market, with huge growth in mobile services and payments and services like on-demand bike sharing. (More here: The highlights of Meeker's China slides.)

- While internet growth is slowing globally, that’s not the case in India, the fastest growing large economy. The number of internet users in India grew more than 28 percent in 2016. That’s only 27 percent online penetration, which means there’s lots of room for internet usership to grow. Mobile internet usage is growing as the cost of bandwidth declines. (More here: The highlights of Meeker's India slides.)

- In the U.S. in 2016, 60 percent of the most highly valued tech companies were founded by first- or second-generation Americans and are responsible for 1.5 million employees. Those companies include tech titans Apple, Alphabet, Amazon and Facebook.

- Healthcare: Wearables are gaining adoption with about 25 percent of Americans owning one, up 12 percent from 2016. Leading tech brands are well-positioned in the digital health market, with 60 percent of consumers willing to share their health data with the likes of Google in 2016.

|

Scooped by

Farid Mheir

|

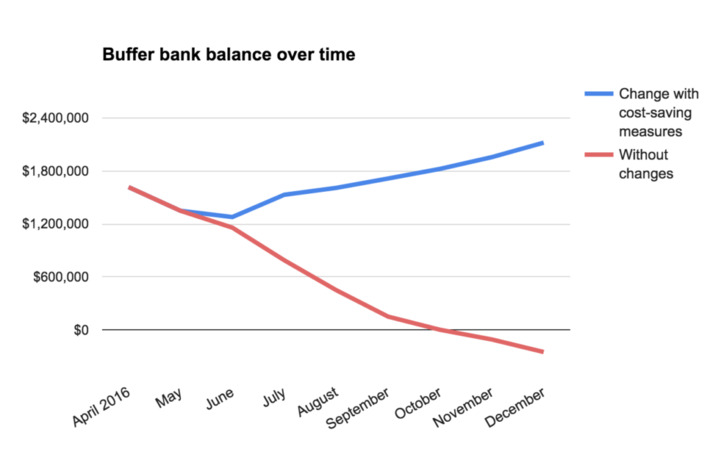

Some tough news: Buffer has made 10 layoffs, 11% of the team. We want to share openly how we got here, the financial details and how we’re moving forward.

|

Scooped by

Farid Mheir

|

|

Scooped by

Farid Mheir

|

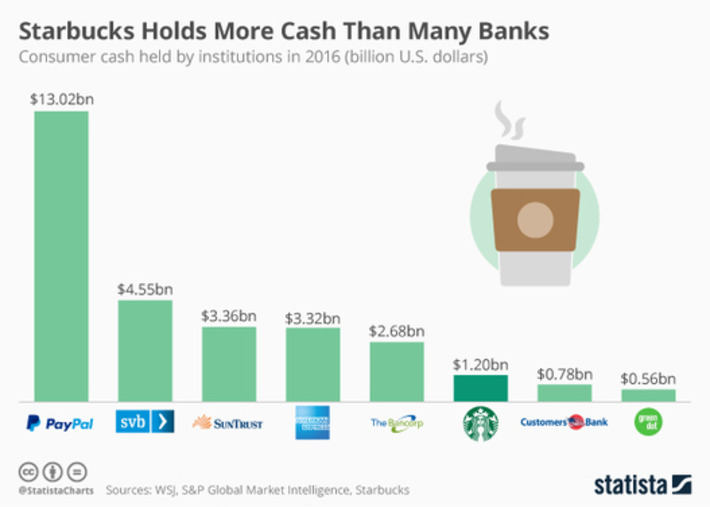

Starbucks customers in the U.S. and Canada are splashing less cash at the coffee chain than ever before. That doesn't mean that they are buying fewer beverages and snacks. Rather, they are embracing the company's loyalty card (which can be loaded with money) and app. The company has 12 million loyalty members in the U.S. alone and that means that Starbucks boasts a serious amount of cash on its customer cards. Wall Street Journal data featured in Market Watch shows that Starbucks has more customer cash than many banks have in deposits. Before long, splashing the cash at your local Starbucks might become a thing of the past. 41 percent of the coffee chain’s customers in the U.S. and Canada now pay for their beverages and snacks after loading money onto their Starbuck’s card. With 12 million loyalty members in the U.S. alone, the coffee chain boasts more customer money on its cards than many banks have in deposits.

According to Wall Street Journal data featured in Market Watch, Starbuck’s customers in the U.S. have loaded at least $1.2 billion onto the company’s cards and app. That’s higher than the deposits held by Customers Bank ($780m) and the Green Dot Corporation ($560m). Starbucks still has a long way to go to catch Paypal which boasts a whopping $13 billion on its customer accounts across the world.

|

Scooped by

Farid Mheir

|

IBM has created a 'consensus algorithm' to help with decision-making, as well as smart contracts templates that can be coded in Java or Gola.

|

Scooped by

Farid Mheir

|

But my brand spanking new chip card from a UK issuer not only arrived with a 2000s app of a 1990s implementation of a 1980s product (debit) on 1970s chip, it also came with a 1960s magnetic stripe on it and a 1950s PAN with a 1940s signature panel on the back. It’s no wonder it seems a little out of place in the modern world.

|

Scooped by

Farid Mheir

|

Bitcoin continues to be a controversial digital currency. But the financial world is buzzing about new applications for the blockchain, the underlying technology that makes Bitcoin possible. Here's how it works.

|

Scooped by

Farid Mheir

|

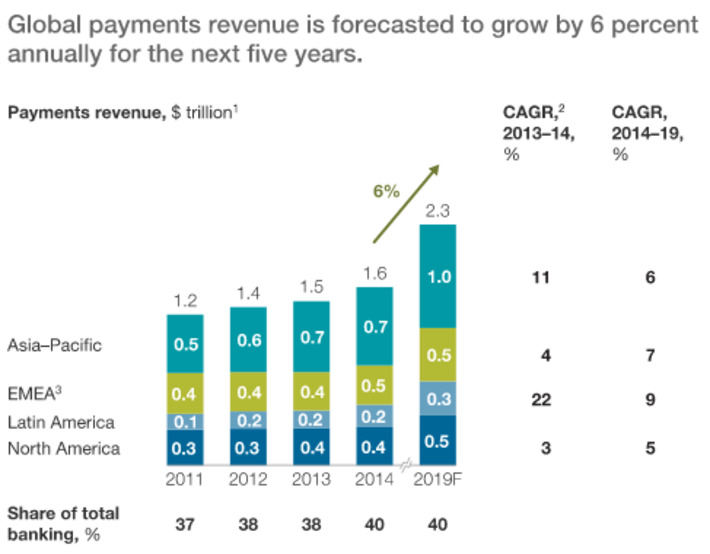

While we expect the payments industry to keep growing at a healthy rate, powerful disruptive forces will begin to reshape the global landscape. A McKinsey & Company article.

|

Scooped by

Farid Mheir

|

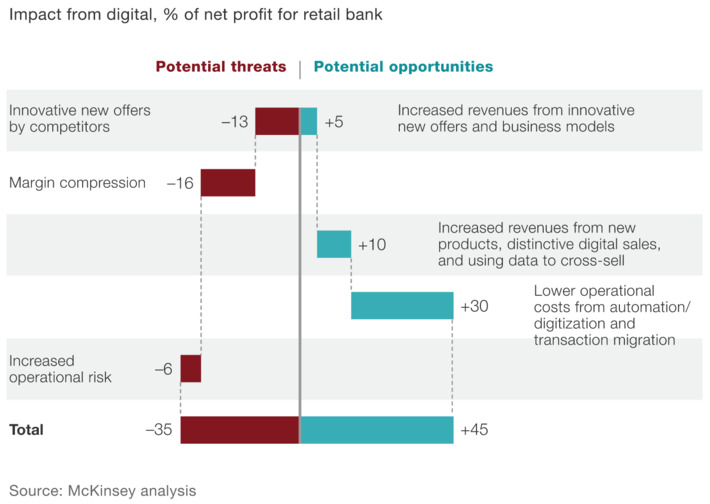

Consumers around the world are quickly adopting digital banking. Incumbents only have a short period to adjust to this new reality or risk becoming obsolete. A McKinsey & Company article.

|

Scooped by

Farid Mheir

|

Technology is getting smarter, faster. Are you? Experts including the authors of The Second Machine Age, Erik Brynjolfsson and Andrew McAfee, examine the impact that “thinking” machines may have on top-management roles. A McKinsey Quarterly article.

|

Curated by Farid Mheir

Get every post weekly in your inbox by registering here: http://fmcs.digital/newsletter-signup/

|

Your new post is loading...

Your new post is loading...

WHY IT MATTERS: organizations spend considerable time and effort for financial due diligence but relatively little on technology due diligence. Often this is due to lack of knowledge at the executive or even at the CIO level - especially when acquiring a new tech or in a new field. In the past, I've come to develop an approach where I perform a 360 degree technology audit that not only dives into the capabilities of the solution (the software code) but also on other essential elements of success (software engineering best practice and processes, design and requirements, etc.).