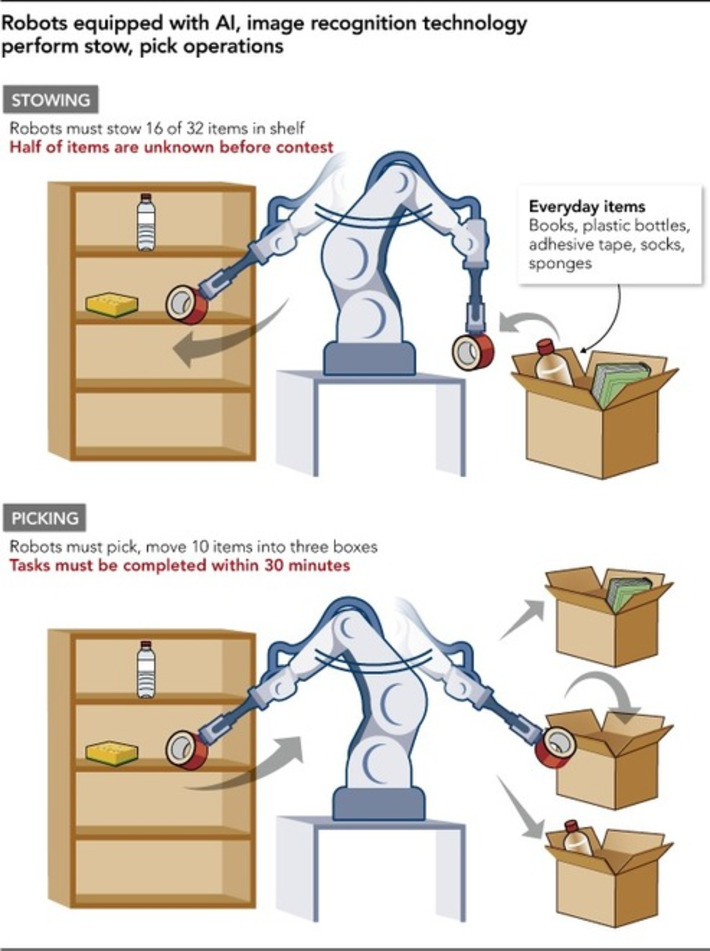

This white paper explores the limitations of current e-commerce and omni-channel distribution and order fulfillment systems. In addition, it takes an in-depth look at how to evaluate various logistics concepts coupled with real-life application challenges and introduces NextGen automated handling systems and companion software. This white paper does so with the concept of stocking 1 million SKUs and moving them at rates of 1 million units per day with just 1-hour lead time and minimal labor requirements.

Get Started for FREE

Sign up with Facebook Sign up with X

I don't have a Facebook or a X account

Your new post is loading... Your new post is loading...

FlashWebsiteHeader's curator insight,

February 28, 2018 4:28 AM

Lay out the substance. The key is to keep your Custom brochure design company basic and successful. An excess of data may make the pamphlet seem jumbled. Therefore, your message will be lost. Farthest point the quantity of hues used to in the vicinity of two and four and utilize each shading reliably. For instance, utilize one shading for the headings and subheadings, and another for general content.

Graphics Design's curator insight,

February 15, 2018 6:25 AM

Budget hearing center provides Hearing Aids MN to those people which are disabled by ear voice.

Graphics Design's curator insight,

February 5, 2018 1:41 AM

In the event that you are good to go, custom vinyl banner design pulling in new clients could expand your pay. Flags are utilized to pull in the eye of potential customers like nothing else. Indeed, they are a basic device, have been previously and will keep on later on.

Jose Alberto's curator insight,

March 30, 2016 5:08 PM

Honestly I can't tell if this is digital transformation per se, but it clearly shows an example of "no-limits" transformation!!!

Yendi Cohen's curator insight,

April 1, 2016 2:04 AM

Honestly I can't tell if this is digital transformation per se, but it clearly shows an example of "no-limits" transformation!!!

over50time's curator insight,

March 19, 2016 11:37 AM

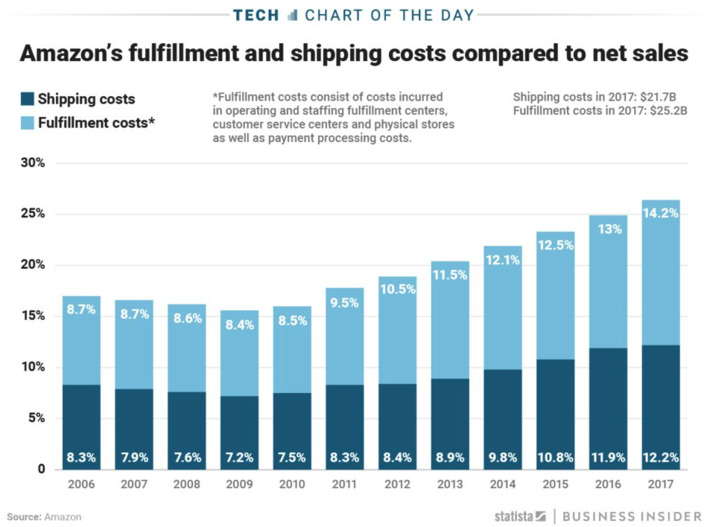

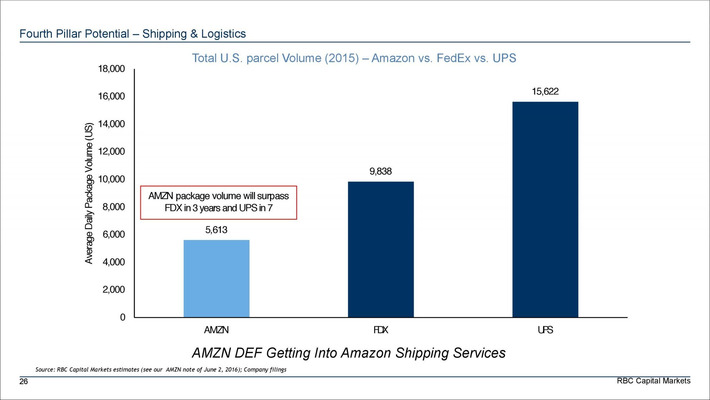

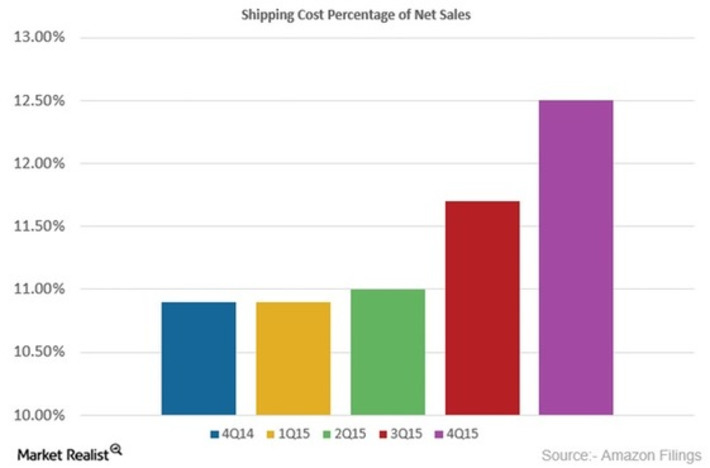

Amazon is by far the largest online retailer. If its shipping costs are growing, as they appear to be, all other retailers should take note as they should expect the same.

This analysis suggests that we have started to use Amazon to buy smaller products more often, which in turns cost more to be delivered compared to the price of the item. Thus the surge. This may indeed be right, as Amazon Prime cuts down on the incentive to increase basket size to get free delivery.

So for Amazon the solution may be to increase the Amazon Prime membership price, open physical stores (as they have announced) or accelerate its deployment of local distributiuon centers to get closer to customers - thus reducing delivery costs, and delays. Or do all three!

For other retailers, the solution may be as simple as keeping the minimum order size to a high enough value that ensures sufficient margin to account for the free delivery costs.

Frédéric Leconte's curator insight,

March 21, 2016 3:51 AM

Amazon is by far the largest online retailer. If its shipping costs are growing, as they appear to be, all other retailers should take note as they should expect the same.

This analysis suggests that we have started to use Amazon to buy smaller products more often, which in turns cost more to be delivered compared to the price of the item. Thus the surge. This may indeed be right, as Amazon Prime cuts down on the incentive to increase basket size to get free delivery.

So for Amazon the solution may be to increase the Amazon Prime membership price, open physical stores (as they have announced) or accelerate its deployment of local distributiuon centers to get closer to customers - thus reducing delivery costs, and delays. Or do all three!

For other retailers, the solution may be as simple as keeping the minimum order size to a high enough value that ensures sufficient margin to account for the free delivery costs.

Juan Ortega's curator insight,

May 20, 2016 4:48 AM

Amazon empezó con gastos de envío gratis... pero en la gráfica podemos observar como los costes han ido aumentando...

|

Curated by Farid Mheir

Get every post weekly in your inbox by registering here: http://fmcs.digital/newsletter-signup/

|

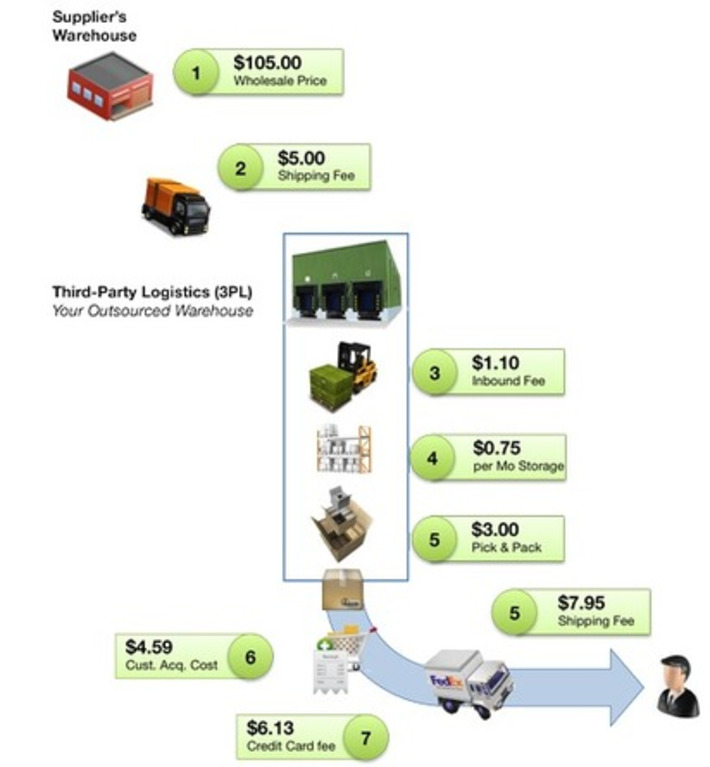

eCommerce changes the way warehouses operate!

New Warehouse Design for eCommerce