Selected quotes include:

- Mossberg asks if Bezos wants to build a delivery system. "No, but we're aiming to supplement it heavily," he says.

- During peak holiday seasons, Amazon has to bring in its own trucks in many countries, he says.

- "We'd always like better prices" from FedEx, Bezos says.

- "We are driven to supplement their capacity," he says. "We're growing our business with UPS. We're growing our business with the US postal service. And we're still supplementing it."

Your new post is loading...

Your new post is loading...

Jeff Bezos said during Code conference that Amazon will not get into the delivery business to replace partners - but will supplement it heavily.

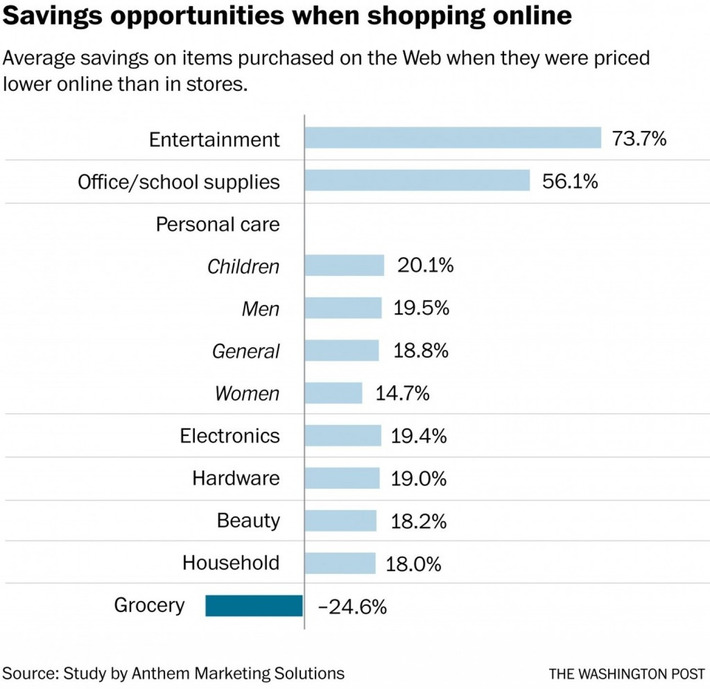

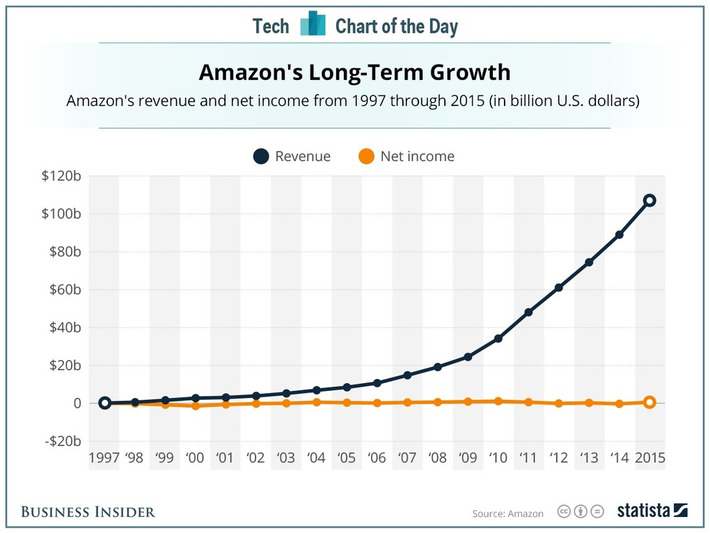

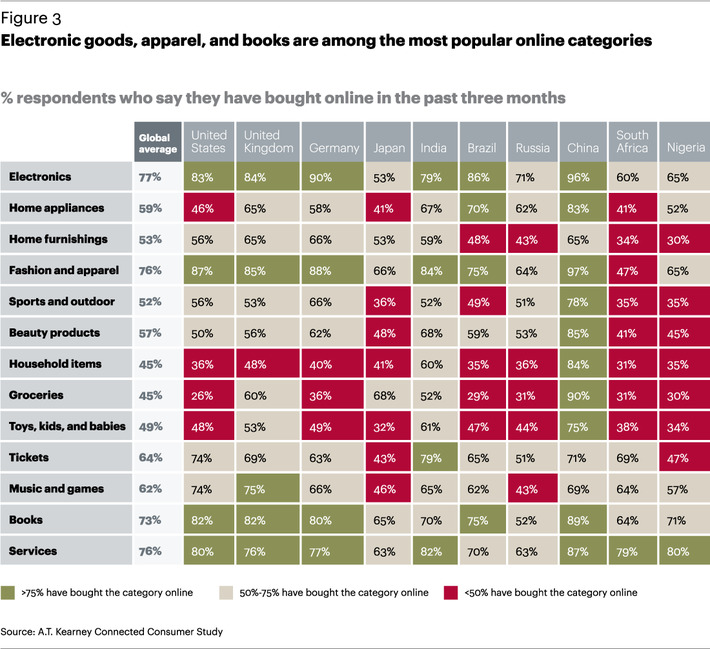

I wrote before that amazon will get into the grocery food delivery business because it is the only way they can reduce their delivery costs - costs they have to give to fedex, purolator, USPS and others. So basically they will go into grocery business to break even and get free local delivery in certain key market areas.

Recently, Walmart has begun pilot tests to deliver groceries using UBER (http://www.reuters.com/article/us-wal-mart-groceries-idUSKCN0YP0H6?il=0). This sounds like a great idea, focussing on each other's strength (walmart = products & logistics, uber = delivery) with no investment to access huge volume. This option may not be as efficient as the Amazon model however but be a great solution in periods of high volume.

To see what I wrote about this, see http://www.scoop.it/t/digital-transformation-of-businesses?q=amazon+fresh

WHY THIS IS IMPORTANT

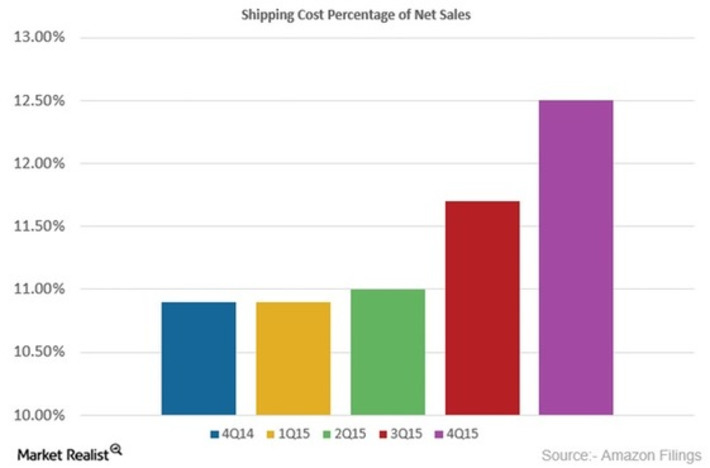

Delivery remains the biggest cost for online retailers. Between 10% to 20% of retailer costs are sunk into delivery. This remains a huge hurdle for both retailers and consumers compared to physical stores. I expect online retailer to be more and more creative on the delivery front to reduce costs and deliver faster.

Established eCommerce retailers should look for opportunities to improve delivery and newbies to never underestimate delivery as it is the CORE to make or break their online retail business. Mark my words...